The fact that they have now begun to produce oil from Kashagan and that we know the project costs are $48 billion gives me a reason to look at a report that Goldman Sachs presented in March 2012, ”360 projects to change the world”. They have studied how much oil and gas the various projects are planned to deliver and the very interesting information on what oil price is needed for the projects to be profitable. The fact that all new projects need financiers means that new projects are well documented. It also makes it possible to do this analysis. The analysis can be seen as one of optimal possible new future oil production. An important conclusion one makes is that OPEC will not generate any new reserve capacity before a future economic recovery occurs.

Below are the conditions that Goldman Sachs has specified that they have used for the analyses of future oil and gas production from the 360 projects. An important point to note is that “this report is based on the current cost environment and does not assume potential future cost inflation.”

If we study the figure, we see that there is a limited number of projects that are profitable if the price is under US$50 per barrel. One of these is Johan Sverdrup in Norway. The production that Goldman Sachs gives is each field’s peak oil production, and then they sum the various fields’ production to give a “cumulative peak oil production.” (It is interesting that they use the concept of Peak Oil just as ASPO has defined it.) Of the fields profitable at under US$50 per barrel, it is Lula in Brazil that will make the largest contribution to production. Lula is a giant field found by Petrobras in 2006. In January 2013 it produced 100 kb/d, and the Brazilians plan its production to be 500 kb/d in 2020. Eventually, there is a stated ability to produce 1000 kb/d. If one studies the detailed tables in the Goldman Sachs report, then one sees that Goldman Sachs estimates that Lula will reach Peak Oil in 2024 at a production rate of 1,750 kb/d, i.e. considerably more than estimated by the Brazilian’s themselves. For Johan Sverdrup, Goldman Sachs gives Peak Oil production at 500 kb/d in 2021. The question is whether Lundin and its partners will choose to produce oil from Johan Sverdrup at this rate.

Most of the future projects require an oil price of between $50 and $90 per barrel to be profitable. At just over the $70 per barrel profitability threshold we find shale oil production from the Bakken field. Peak Oil production for the Bakken is estimated to occur in 2017 at around 1,000 kb/d. Shale oil production from the Eagle Ford in Texas requires a price of a little under $70 per barrel to be profitable and Eagle Ford is also estimated to reach peak oil in 2017 but they only foresee a maximal production rate of 450 kb/d.

Finally, let’s look at Kashagan where Goldman Sachs estimates that an oil price over $125 per barrel is required for the project to be profitable. They believe that Kashagan will reach Peak Oil in 2030 with a production rate of around 1,400 kb/d. The first stage that they have now opened for production is estimated to give 370 kb/d and the question is whether this production can be profitable without continuing to the following stages. What the cost of these will be is uncertain but considering that the first stage was twice as expensive as originally estimated there is a risk that the subsequent stages will also be expensive.

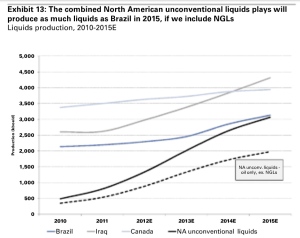

Goldman Sachs has summarized the total production for some of the nations we have discussed. We see that Brazil is estimated to produce 3 million barrels of oil per day (Mb/d) in 2015 and if we add together the production of oil and NGL then North American unconventional oil production is estimated to be 3 Mb/d – but note that 1 Mb/d of that is NGL. It is not impossible that these levels of production will be reached.

Finally, I want to show the total Peak Oil and Peak Gas production for the 360 projects that Goldman Sachs has analyzed. It will be very interesting to see if this becomes a reality. We know already that Lula is overestimated and the question is by how much the other fields are overestimated.

Read more: https://aleklett.wordpress.com/2013/09/16/goldman-sachs-360-projects-to-change-the-world-english/