Contents Of Newsletter 35

- 262. Those who control future oil supply find common ground

- 263. Country Assessment – Mexico

- 264. The Uppsala Protocol

- 265. In Memoriam – L.F. {“Buzz”) Ivanhoe

- 266. Exxon-Mobil confirms depletion

- 267. Updated Discovery Data

- 268. Oil Depletion in Latin

- 269. Lectures on Depletion

- 270. Russia moves towards the euro for oil trade

- 271. An important book on population.

- 272. New US Energy Policy Proposals

- 273. Is this a portent?

- 274. New Book on Oil Depletion

- 275. Important meeting in Denmark on Oil Depletion

- 276. Oil depletion recognised by the Argonne Laboratory

- 277. Matt Simmons spells it out

- 278. Countries facing radical changes

- 279. It’s Time to Prepare for a Tax Shift

262. Those who Control Future Oil Supply Find Common Ground

Saudi-Russian detente driven by need to control oil

by Marwan Al Kabalan, 19/09/2003

When the World Trade Centre (WTC) appeared ablaze on the world’s television screens, it was already apparent that the incident would affect world politics in an unprecedented manner. The September 11 attacks on the US changed the rules of international politics and altered the way in which modern warfare is conducted, and alliances are formed.

China, for instance, which was regarded by Washington as the most likely threat to its global hegemony after the end of the Cold War, became a close partner in the war on terrorism, whereas traditional allies, such as France and Germany, were chastised by US officials for their “obstructive” role in the war against Iraq. The most important change, however, affected US-Saudi relations.

For almost 60 years US-Saudi relations were based on mutual interests wherein the US assured Saudi Arabia security in exchange for uninterrupted oil supplies at reasonable prices.

Mutual dependency increased after the 1973 Arab oil embargo where oil emerged from being essentially a commercial-financial interest of American businesses to become a significant component of the US national security strategy.

Saudi Arabia became, thus, a key state in Washington’s foreign policy calculations lending credit to State Department officials who once held the view that “there (was) no country in the world of greater economic, and therefore strategic, importance to the US than Saudi Arabia.”

This long history of close friendship was buried under the rubble of the WTC. Saudi Arabia was regarded by the US after September 11, 2001, as not so safe place to dwell – Washington’s new concern after the collapse of communism.

By this policy-line, the US moved hastily to implement an emergency plan intended to find other energy resources to substitute Saudi oil. In fact, the attacks on the WTC provided an extremely convenient pretext to cut Saudi influence in the oil market, something that has always been regarded as a matter of utmost urgency for the influential pro-Israel elements in the Bush administration.

Iraq and Afghanistan were already on the US radar, and military action against the two countries was under contemplation well before the September 11 attacks.

In a study by the Baker Institute for Public Policy, an influential think tank based in Texas, prepared at the behest of the US Energy Department, it was stated that “the US remains a prisoner of its energy dilemma” and because this was an unacceptable risk to the US, “military intervention” in Iraq was necessary.

Similar evidence exists in Afghanistan. The US government saw the Taliban regime as a hindrance for the construction of oil pipelines from the Turkic republics of Central Asia, through Afghanistan and Pakistan, to the Indian Ocean.

The removal of the Taliban was, thus, necessary to make the project doable. Eighteen months after the twin towers collapsed, the two plans were implemented, and Iraq and Afghanistan fell under US control.

Control of Iraqi oil by the US, getting closer to the oil fields of the Caspian Sea and Central Asia and attempting to form an alliance with African oil producers constituted a significant threat to Saudi influence in the oil market.

And in the face of mounting American pressure to alter its domestic and foreign policies, Saudi Arabia had to do something to counteract Washington’s increasing belligerency. Saudi impatience with US policies reached a climax ahead of a visit by Saudi Crown Prince Abdullah bin Abdulaziz to Washington last year. In April 2002, a senior Saudi official warned that to survive, the Kingdom would contemplate joining with America’s worst enemies.

There was another possibility, however, which was not mentioned in the Saudi statement – embracing the Russian bear.

Russia is the world’s second-largest oil producer, and for years it has been pressed by Washington to increase its share in the oil market at the expense of Opec. US efforts to bring Russia to the center stage in the oil market paved the way for the Saudi-Iranian conciliation in 1997, which resulted in curbing Russia’s assertiveness to sideline Opec.

For similar reasons, Saudi Arabia did all it possibly could to resolve the Iraqi crisis peacefully and avert a US attack. It included a historic embrace between Prince Abdullah and former Iraqi Vice President, Ezat Ibrahim, at the Beirut Arab summit in March 2002.

Riyadh rightly feared that the fall of Iraq to the US would allow the latter to use Iraqi oil to undermine Opec. The failure to prevent the US from controlling Iraq forced Saudi Arabia to explore new territories to keep Opec’s influence afloat, hence, Prince Abdullah’s visit to Moscow.

Prince Abdullah tried to convince Russia to co-operate, rather than compete, with Opec. Furthermore, he attempted to take advantage of Russia’s fears of total US control of Iraqi oil to convince it to join the oil cartel. More significant, perhaps, was the Prince’s offer to open Saudi Arabia’s vast gas and oil sector to Russian investments.

In an attempt to disperse Russian fears of Arab support for Chechen Mujahideen, Prince Abdullah recognized Russian sovereignty over Chechnya and met the pro-Moscow Chechen presidential candidate, Ahmed Qadyrov. Riyadh also promised to consider a Russian request to join the Organisation of the Islamic Conference as an observer, if Russia agrees, in return, to join Opec or at least co-operate in stabilizing the oil market.

The visit, which was unthinkable two years ago, paid dividends with the two countries signing a five-year agreement to strengthen “bilateral co-operation with the goal of ensuring stability in the global oil market.”

This agreement, if implemented, would bring the two largest oil producers together with an output of 17 million barrels per day. It would also ease the US pressure on Saudi Arabia and put an end to Washington’s endeavors to undermine Opec, at least for now. (The writer is a scholar in International Relations in the UK.)

(Reference furnished by Jean Laherrère)

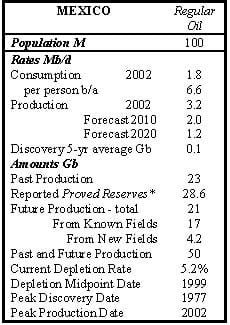

263. Country Assessment – Mexico

Mexico covers an area of two million square kilometers, is bordered by the United States to the north and Guatemala and Belize to the south. A central plateau between 1000 and 2000 m above sea-level is flanked by two branches of the Sierra Madre mountains, which are capped by volcanic peaks rising to almost 6000m in height. Baja California forms a long peninsula on the Pacific margin in the northwest of the country, while the Yucatan Peninsula in the south flanks the Gulf of Mexico, being made up in part of inhospitable limestone karst country. Much of Mexico is arid, although rainfall is higher in the coastal areas and the some of the highlands of the south. The population has risen six-fold since 1900 to 100 million, of whom about sixteen million live in Mexico City, one of the World’s larger and most polluted capitals. An additional seven million Mexicans live in the United States.

Mexico has been inhabited for 20 000 years and attained a high level of civilization towards the end of the first millennium when the Aztecs rose to prominence before falling to the Spanish conquistadores under Cortez in the 1520s. Along with Colombia and Peru, Mexico became one of the administrative centers of the Spanish Latin American Empire. Its territory extended over what are now the southern states of the United States.

Various inconclusive moves toward independence finally culminated in the declaration of a Republic in 1824. But US immigrants had begun to settle in the northern territories in large numbers, prompting a conflict, which led to the US-Mexican War of 1846-48. Mexico lost its northern territories, now comprising Texas, California, New Mexico, Arizona, Nevada, Utah and much of Colorado.

As in other Latin American countries, independence brought instability as different factions vied for power. One such faction secured the support of Napoleon III of France, who in 1862 landed an army, establishing Maximilian, an Austrian grandee, as Mexico’s new Emperor. He saw himself as a benign despot but did not quite receive the welcome he expected. The French forces withdrew five years later under pressure from the United States, and the unfortunate Maximilian was executed by a rival leader, General Juarez.

Porfirio Diaz came to power in 1876 following another rebellion. He led an efficient if autocratic, the government that survived until 1911, and is remembered for his famous dictum “Poor Mexico – so far from God yet so close to the United States.” Growing demands for social reform and a fairer distribution of wealth led to the formation of the Partido Nacional Revolucionario (PRM), which under various leaders has dominated Mexican politics to the present day. It can probably be well described as a national socialist party, springing from the same pressures as manifested themselves in pre-war Europe.

In 1992, Mexico entered into a possibly disastrous free-trade Treaty (NAFTA) with the United States and Canada, which was supposed to stimulate trade, but in reality led to the greater foreign control of Mexican industry and the outflow of capital through the hidden influence of a foreign trading currency.

Emigration to the United States, both legal and illegal, continues on a massive scale, with remittances to the home country being a major source of income. Tourism too contributes greatly, but the country remains financially troubled, being given to periodic crises when the peso collapses in value. A low-level revolt simmers in the southern province of Chiapas where inhabitants of Mayan origin seek to recover their lands.

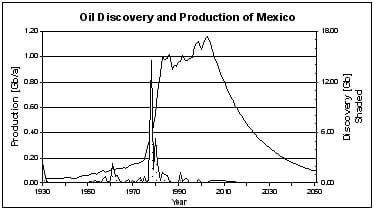

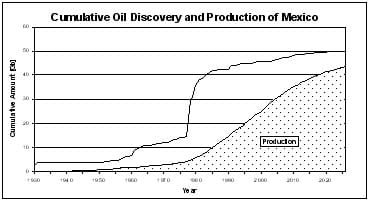

Oil exploration took off during the early years of the 20th Century being led by Mexican Eagle, a British company controlled by Lord Pearson, who was involved in constructing railways in the country. Several American companies were also involved. One highly prolific field after another was found in what became known as the Golden Lane, near Tampico, where fractured Cretaceous carbonate reservoirs gave exceptionally high flow rates. As a result, Mexico accounted for as much as one-quarter of world production during the early years of the last Century. But nationalism and disputes over the rightful share of the proceeds of exploiting the national patrimony led the country to expropriate the foreign oil interests in 1938, setting an example, later to be followed by most of the other major producing countries. A state company, known as Petroleos de Mexico (Pemex) was established to take exclusive control of the national industry. It is widely seen as a bureaucratic and overstaffed enterprise with political influence, but in a sense, Mexico can be pleased if it is less dynamic than some of its private counterparts for the rate of depletion would be reduced as a consequence. In any event, it was responsible for a second major cycle of discovery during the late 1970s as the offshore extensions of the earlier trend were opened up, yielding a string of giant fields.

Mexico’s reserve reporting has been highly suspecting. In 1980, reserves were stated to be 44 Gb, rising to 56 Gb in 1989 before declining to 48 Gb in 1998, but then they suffered an implausible collapse, dropping to 27 Gb in 2001 and 12.5 Gb in 2002. The explanation may lie in part in the treatment of the large but sub-commercial Chicontopec Field, or there may be some more devious political reasons, possibly to deter (or encourage) moves towards the privatization of Pemex, and the re-entry of US companies under the NAFTA provisions. Here, the reserves are tentatively estimated at 21 Gb. Pemex started a massive nitrogen injection project on the Cantarell field in 1997 to prolong its life, but it is now set to decline steeply. Mexico may have some deepwater potential in the Gulf of Mexico, here tentatively estimated at 5 Gb, with production being expected to peak around 2015.

Mexico is here assessed to be capable of producing a total of 50 Gb to 2075, giving a midpoint of depletion in 1999, some fourteen years after what appears to be an actual premature peak in 1985. Production now stands at about 3.2 Mb/d, being subject to a relatively high depletion rate of 5% a year.

Gas production stands at 1.2 Tcf/a, somewhat below the 1999 level, which may represent peak., with reserves of 53 Tcf (of which only 8.8 Tcf are surprisingly described as Proved). Consumption is running at 1.5 Tcf, making Mexico a net importer from the United States, which is unlikely to continue given the growing gas shortages in that country. It sounds as if the lights will be going out to Mexico soon.

Oil consumption is running at about 1.8 Mb/d meaning that the country will become a net importer by around 2010, assuming no increase in demand. By 2050, production will have fallen to about 400 kb/d, which may imply a massive reduction in population, given the central role of oil in an already fragile economy and the dependency of urban dwellers on food transport. The Rio Grande threatens to be a tough frontier.

264. An Oil Depletion Protocol – The Uppsala Protocol

As the prospects for the Kyoto Protocol fade with Russia’s decision to join the United States in declining to participate, attention may turn to the proposed oil depletion Protocol, which addresses the raw necessity of managing the decline of oil as imposed by natural depletion. That in itself has an impact on the emissions, which it is feared, may be affecting the climate. The text of the Protocol, which was reported by CNN on 2nd October, is as follows:

WHEREAS the passage of history has recorded an increasing pace of change, such that the demand for energy has grown rapidly in parallel with the world population over the past two hundred years since the Industrial Revolution;

WHEREAS the energy supply required by the population has come mainly from coal and petroleum, having been formed but rarely in the geological past, such resources being inevitably subject to depletion;

WHEREAS oil provides ninety percent of transport fuel, essential to trade, and plays a critical role in agriculture, needed to feed the expanding population;

WHEREAS oil is unevenly distributed on the Planet for well-understood geological reasons, with much being concentrated in five countries, bordering the Persian Gulf;

WHEREAS all the major productive provinces of the World have been identified with the help of advanced technology and growing geological knowledge, it being now evident that discovery reached a peak in the 1960s, despite technological progress, and a diligent search;

WHEREAS the past peak of discovery inevitably leads to a corresponding peak in production during the first decade of the 21st Century, assuming no radical decline in demand;

WHEREAS the onset of the decline of this critical resource affects all aspects of modern life, such having grave political and geopolitical implications;

WHEREAS it is expedient to plan an orderly transition to the new World environment of reduced energy supply, making early provisions to avoid the waste of energy, stimulate the entry of substitute energies, and extend the life of the remaining oil;

WHEREAS it is desirable to meet the challenges so arising in a co-operative and equitable manner, such to address related climate change concerns, economic and financial stability and the threats of conflicts for access to critical resources.

NOW IT IS PROPOSED THAT

1) A convention of nations shall be called to consider the issue to agreeing on an Accord with the following objectives:

- a) To avoid profiteering from shortage, such that oil prices may remain in reasonable relationship with production cost;

- b) to allow developing countries to afford their imports;

- c) to avoid destabilizing financial flows arising from excessive oil prices;

- d) to encourage consumers to avoid waste;

- e) to stimulate the development of alternative energies.

2) Such an Accord shall have the following outline provisions:

- a) No country shall produce oil at above its current Depletion Rate, such being defined as annual production as a percentage of the estimated amount left to produce;

- b) Each importing country shall reduce its imports to match the current World Depletion Rate, deducting any indigenous production.

3) Detailed provisions shall cover the definition of the several categories of oil, exemptions and qualifications, and the scientific procedures for the estimation of Depletion Rate.

4) The signatory countries shall co-operate in providing information on their reserves, allowing a full technical audit, such that the Depletion Rate may be accurately determined.

5) The signatory countries shall have the right to appeal their assessed Depletion Rate in the event of changed circumstances.

265. In Memoriam – L.F. (“Buzz”) Ivanhoe

It is with great sorrow that we report the death on 27th September of Buzz Ivanhoe at the age of 83. He was one of the pioneers of oil depletion studies. His early work was in mining and seismic surveying in South America and Canada. Later, he became an international oil consultant, eventually having a key role with Occidental Petroleum. His wide experience gave him an ability to quickly spot the more promising areas, which in turn led him to grasp the essential nature and importance of depletion. He published widely on the subject. He was a philanthropist, whose last major contribution was to fund and compile the Hubbert Newsletter to alert his country to the serious impact of depletion. (Read his last newsletter about “Petroleum Positions of United States (US/48 & Alaska), Canada, Mexico North American Region”.

266. Exxon-Mobil confirms depletion

Exxon-Mobil in a statement by the President of the exploration company continues to take the lead in emphasizing the difficulty of meeting oil demand ( The Lamp vol. 85/1 p20 ). It is another way of describing an imminent peak in production:

“Our industry can certainly be proud of its past achievements. The challenges we will face in the coming years will be every bit as great as those encountered in the past, due in part to ever-increasing global energy use. For example, we estimate that world oil and gas production from existing fields is declining at an average rate of about 4 to 6 percent a year. To meet projected demand in 2015, the industry will have to add about 100 million oil-equivalent barrels a day of new production. That’s equal to about 80 percent of today’s production level. In other words, by 2015, we will need to find, develop and produce a volume of new oil and gas that is equal to eight out of every 10 barrels being produced today. Also, the cost associated with providing this additional oil and gas is expected to be considerably more than what industry is now spending.

Equally daunting is the fact that many of the most promising prospects are far from major markets — some in regions that lack even basic infrastructure. Others are in extreme climates, such as the Arctic, that present extraordinary technical challenges.”

267. Updated Discovery Data

We express great gratitude for the receipt of reliable information on world discovery in 2002 (see Item 255 in Newsletter 34). A total of 7.5 Gb for oil and gas liquids was found, which is higher than earlier indications. But about 50% was in the deepwater (>500m), which is excluded from Regular Oil under the ASPO classification. The deep water frontier is confined to specific geological provinces and is probably close to peak discovery, if not already past it.

268. Oil Depletion in Latin

A report in Latin on oil depletion has been published by Brian Regan in Tomus 39, Fasciculus 153 (pp. 412ff.) of “Vox Latina,” a Latin periodical published quarterly out of the University of the Saarland in Germany. It is entitled “Apocalypsis petrolearia,” which needs no translation. Perhaps this Latin text will attract papal attention, which would indeed be appropriate given the moral implications of depletion and the serious impact on humanity.

269. Lectures on Depletion

The following lectures on oil depletion were given by C.J.Campbell:

Uppsala University, September 29th.

6th Petroleum Geology Conference, London, October 8th

Florence University, Italy, October 10th.

Pio Manzu Conference, Rimini, Italy, October 20th

The latter was a particularly impressive occasion, with delegates from many countries representing a wide spectrum of philosophical, ethical, environmental and political thought. The general conclusion from most speakers was a somber warning of a world spiraling out of control as market forces fail to save a growing population from the impact of resource depletion. It was feared that rising temperature combined with depleting aquifers and oil supply would lead to an imminent food shortage. The severe geopolitical consequences of an exploding population and dwindling resources were addressed.

The proposed oil depletion protocol (Item 264 above) attracted particular interest with coverage on radio and television in Sweden and Italy. (See also Item 279 below)

270. Russia moves towards the euro for oil trade

President Putin has expressed certain sympathy for trading oil in euros following a meeting with the German Chancellor. Such a move could have a colossal impact on the US economy. Iraq was moving in the same direction before the invasion, and both Malaysia and Indonesia have followed its example. The imports of physical oil to the United States have been matched by the extension of domestic credit, contributing to the country’s massive negative trade balance. Loans tend to become gifts when the energy component of the collateral withers. A partial shift to the euro for oil trade could have far reaching implications and consequences. Russia will become Europe’s principal energy supplier in the years ahead, so there is a certain logic in using a common currency for the transactions.

271. An Important Book on Population.

The Rapid Growth of Human Population 1750-2000 by William Stanton (Published by Multi-Science. ISBN 0 906522 21 8) is a very important new book giving key historical population statistics by country and an analysis of the grave situation facing the World, as a result of overcrowding and the depletion of resources, including oil. It addresses the inevitable conflicts, ethnic issues, migration and environmental stresses. It is lucidly written in an unemotional style which makes its message even more compelling.

272. New US Energy Policy Proposals

Several mainline US politicians, including Dick Gephardt, Joe Lieberman and John Kerry have come forward with proposals for new energy policies, seeking political advantage from the growing popular awareness of the country’s dependence on Middle East oil and wide disenchantment with Bush’s failing policies as the death toll of US troops in Iraq continues to rise.

Gephardt’s plan, for example, has ten points:

- Improved automobile efficiency

- Tax incentives for improved energy efficiency in buildings

- Development of renewable energies from the wind, biomass, etc

- Government departments to set an example

- Development of clean coal technology

- Better town planning, public transport

- Incentives for marginal oil and gas production

- Continued prohibition of drilling in environmental areas

- More gas storage

- Better control of electricity supply, privatization, etc

Governor Dean of Iowa proposes a move to ethanol grown in his State as well as wind energy.

Dennis Kucinich, a Presidential candidate, is more forthright with the following statement. Perhaps, after all, America will rise to the occasion bringing to bear the well-known dynamic and positive attributes of its people after a regime change.

Thanks to advances in renewables, there are fewer technical obstacles to energy independence for our country. There are many political obstacles — but the oil, auto, and electric utility corporations won’t be directing energy policy in a Kucinich White House. I will spur research and investment in “alternative” energy sources — hydrogen, solar, wind and ocean — and make them mainstream. Clean energy technologies will produce new jobs. We can easily double our energy from renewable sources by 2010. And we can soon have hybrid and fuel cell cars dominating the market. When I was Mayor of Cleveland, I defended public ownership of utilities; when I’m President, I will expand it.

As a peace advocate, I will launch a major renewables effort because then Middle East oil fields will not loom so large as strategic or military targets. As an environmentalist, my view is always holistic and global: a Kucinich Administration will launch a “Global Green Deal” – a major initiative to use our country’s leadership in sustainable energy production to provide jobs to Americans, to reduce energy use here at home, and to partner with developing nations to provide their people with inexpensive, local renewable energy technologies. As a citizen of Planet Earth, I want this project for the same reason I will sign the Kyoto climate change treaty — because we need it for our children and our grandchildren.

(References furnished by Jim Meyer)

273. Is this a portent?

The September issue of World Oil reports that Chevron-Texaco plans to dispose of 550 filling stations in the United States; 900 in Asia and Africa; retail and refining operations in Europe, South America, Australia and the Middle East; and exploration and production holdings in North America, the North Sea, and Papua. The company evidently does not anticipate expanding throughput to feed it’s downstream, yet hopes to deliver strong earnings to Wall Street. It sounds like the actions of a company planning a profitable decline strategy, which indeed would be realistic given the pending peak and decline of world production. In the past, the major companies organized themselves to make the most money at the wellhead for tax reasons, operating the downstream sometimes even at a loss. But now as their proprietary production dwindles they are progressively forced into the role of mere traders, selling oil purchased from the Middle East. It follows that that have to make the downstream more profitable, so it is logical that they should sell off low performing elements in their empires. The action does nevertheless deliver a broader message.

274. New Book on Oil Depletion

A valuable new book has been published in Italy by Ugo Bardi, an ASPO member. It is entitled “La Fine del Petrolio – Combustibili fossili e prospettive energetiche per il ventunesimo secolo” (The End of Oil – Fossil fuels and the energy perspective for the 21st Century) Riuniti ISBN 88 359-5425-8

275. Important meeting in Denmark on Oil Depletion

The Danish Board of Technology and the Danish Association of Civil Engineers are holding an important hearing on oil depletion in Copenhagen on December 10th which will be open to the public.

For details : contact Jette Christensen: jc@tekno.dk + 45 33 45 53 54.

276. Oil depletion recognized by the Argonne Laboratories

Russell Brown of the prestigious Argonne Laboratory in the United States has written an important paper entitled Critical Paths to the Post-Petroleum Age.

Summary

The United States and the world face an energy problem that goes far beyond the need for developing new technologies or building more power plants. As world petroleum production declines, the thermodynamic penalties associated with producing hydrogen or other energy carriers multiply the loss of primary energy.

Each downward step on the primary energy slope has a multiplicative effect. When petroleum supply ends, the effective reduction of U.S. primary energy will be about 56%.

Preparation for both these changes and their effects must begin immediately. If done well, a hydrogen-based transportation system would provide limited personal mobility, decreased agricultural productivity, and increased costs of goods and services. If done either poorly or late, the results could be disastrous.

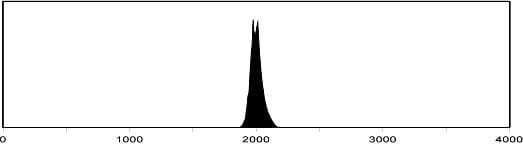

Figure 4, based on the U.S. supply profile shown in Figure 3, offers a historical perspective on the brief petroleum era on a time-scale of 4000 years. It applies to all developed nations. Until the late 19th century, biomass and animate labor supported human life.

277. Matt Simmons spells it out

Matt. Simmons, the prominent Houston banker, has again courageously spelled out the nature of the imminent Energy Crisis in a penetrating presentation at the Rice Global Forum.

278. Countries facing radical changes

The BP Statistical Review lists consumption for most prominent countries. Comparing this with the ASPO production forecasts points to certain countries facing radical changes in their situation. The most noteworthy are as follows. For this exercise, it is assumed that consumption is static, with the positions becoming more extreme if it should grow:

- China: imports rise to 70% by 2020

- United Kingdom: now exporting 50%, has to import 60% by 2020

- Indonesia: now exporting 20%, will have to import 45% by 2020

- Egypt: now exporting 50%, will have to import 50% by 2020

- Argentina: now exporting, will have to import 40% by 2020

- Australia: imports rise to 60% by 2020

- Malaysia: now exporting 45%, will be importing like amount by 2020

- Colombia: exports end by 2020

- Denmark: now exporting, will be importing 55% by 2020

In fact, it is unlikely that the system will be able to tolerate such indicated changes, with a radical fall in consumption being the probable outcome. As more countries become net importers, less and less will be available for the global market.

279. It’s Time to Prepare for a Tax Shift

We should be thinking about the future of energy taxation and other forms of environmental taxation in a broader context than most analysts, economists and politicians have done so far, as the following paper by James Robertson makes clear.

Present Problems and Perversities

Existing tax systems around the world are facing trouble.

- In a competitive global economy, the mobility of capital and highly qualified people will continue to press governments to reduce taxes on incomes, profits, and capital.

- In aging societies, the opposition will grow to tax fewer people of working age on the fruits of their efforts to support growing numbers of what economists call “economically inactive” people.

- Internet trading will make it more difficult for governments to collect customs duties, value added tax and other taxes and levies on sales. The internet will also make it easier to shift earnings and profits to low-tax regimes.

- Tax havens were estimated to hold $6 trillion worldwide as long ago as 1998, resulting in massive tax losses to national governments, criminal money laundering, and economic distortion.

The best way to deal with these problems will probably be to shift taxation away from things like incomes, profits, capital, and value added that could migrate from one place to another and on to things like land which cannot migrate.

These growing pressures on the existing tax base reinforce the economic, social and environmental arguments for taxing “bads,” not “goods.”

Existing tax structures all round the world are, in fact, absurdly perverse.

- They fall heavily on employment and rewards for work and enterprise, and lightly on the use of common resources. So they encourage all-round inefficiency of resource use – over-use of natural resources (including energy and the environment’s capacity to absorb pollution), and under-employment and under-development of human resources.

- Today’s taxes are also unfair and illogical. They penalize value added – the positive contributions people make to society. They fail to penalize value subtracted; they don’t make people and businesses pay for the value of the common resources they use or monopolize, thereby preventing other people from using them.

- The present tax system is unjust in another way. It makes it easy for rich people and businesses to escape, or at least minimize their tax obligations because they can afford to use tax havens, family trusts, and a range of other devices set up by expensive bankers, lawyers, and accountants. It is much more difficult for less wealthy people and poor people to do that.

Sharing the Value of Common Resources

A new approach needs to be worked out, based on collecting the value of common resources as public revenue for the benefit of all citizens.

Common resources are resources whose value is due to Nature and the activities and demands of society as a whole, and not to the efforts or skill of individual people or organizations. The land is an even more obvious example than energy. The value of a particular land-site, excluding the value of what has been built on it, is almost wholly determined by the activities and plans of society around it. For example, when the route of the London Underground Jubilee line was published some years ago, properties along the route jumped in value. Access to them was going to be much improved. So, as a result of a public policy decision, the owners of the properties received a £13bn windfall financial gain. They had done nothing for it; they had paid nothing for it; they had been given a very large free lunch. In 1994, based on 1990 values, I calculated that the absence of a site-value tax on land cost UK taxpayers £50bn to £90bn a year in lost public revenue.

By contrast, the auction three years ago of twenty-year licences to use the radio spectrum for the third generation of mobile phones raised £22.5bn for the UK government. The governments of Germany, France and Italy also raised very significant sums from that common resource.

Important common resources include:

- land (its site value)

- energy (its unextracted value)

- the environment’s capacity to absorb pollution and waste

- the use of limited space (e.g., for road traffic, airport landing slots)

- water – for extraction and use, and for waterborne traffic

- the electro-magnetic (including radio) spectrum.

The annual value of these is very great. Collecting it as public revenue would remove the need for many existing taxes. (There are other common resources too, such as the value created by issuing new money, almost all of which now gives a free lunch to commercial banks and their stakeholders. But the remedy for that lies outside the field of what is strictly regarded as taxation.)

The Global Dimension

The 21st Century development of international institutions for dealing with world public revenue should be based similarly on sharing the value of common resources.

In 1995, the Commission on Global Governance recognized the need for global taxation “to service the needs of the global neighborhood”. It proposed making nations pay for the use of global commons, including:

- ocean fishing, sea-bed mining, sea lanes, flight lanes, outer space, and the electro-magnetic spectrum; and for

- activities that pollute and damage the global environment, or cause hazards beyond national boundaries, such as emissions of CO2 and CFCs, oil spills, and dumping wastes at sea.

Some of the revenue from global taxes would then provide stable sources of finance for global commitments, including international peace-keeping. The rest might be distributed to all nations according to population size, reflecting the right of every person in the world to a global “citizen’s income” based on fair shares of the value of global resources.

This approach would;

- encourage environmentally sustainable development worldwide;

- generate a much-needed source of stable revenue for the United Nations;

- provide substantial financial transfers to developing countries by right and without strings, as payments for the rich countries’ disproportionate use of world resources;

- help to liberate developing countries from dependence on grants and loans from institutions like the World Bank and the International Monetary Fund which the rich countries now dominate;

- help to solve the problem of Third World debt;

- it would recognize the shared status of all people as citizens of the world; and

- contribute to global security by helping to reduce the spreading sense of injustice in a globalized world.

(Extracted from a paper given by James Robertson at a session on “Sharing Limited Resources and a Change of Course” at the XXIX Annual Conference of the Pio Manzu International Research Centre in Rimini, Italy on 18-20 October 2003. The further brief background is in Schumacher Briefing No.1 on “Transforming Economic Life,” Green Books, Totnes, England, 1998.)